inheritance tax rate indiana

Note that these rates are paid in. No tax has to be paid.

Indiana has a three class inheritance tax system and the exemptions and tax rates.

. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am430 pm ET or via our mailing.

This means without an Indiana inheritance tax Indiana estates have to be greater than 525 million before any state or federal death taxes would be due. The estate tax is a tax on a persons assets after death. Indiana used to impose an inheritance tax.

This tax ended on December 31 2012. Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers.

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Each heir or beneficiary of a decedents estate is divided into three classes. Inheritance tax was repealed for individuals dying after December 31 2012.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for. Up to 25 cash back Update. A strong estate plan starts with life.

An inheritance tax is a state tax that youre required to pay if you receive items like property or money from a deceased person. The Inheritance Tax Return must be filed with the Indiana Department of Revenue PO. Each class is entitled to.

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. It fully taxes withdrawals from retirement accounts.

So no inheritance tax returns Form IH-6 for Indiana residents for Form IH-12 for non-residents have to be prepared or filed. The state does not tax Social Security benefits. In additon no Consents to Transfer Form.

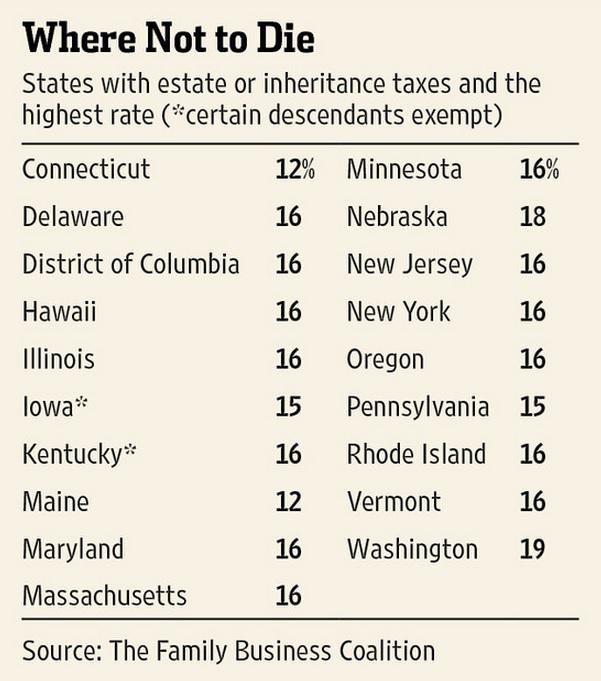

Click the nifty map below to find the current rates. Note that historical rates and tax laws may differ. The act was amended in 1915 1917and 1919.

The table below shows the income tax rates for all 92 Indiana counties. Box 71 Indianapolis IN 46206-0071. Does Indiana Have an Inheritance Tax or Estate Tax.

Indiana inheritance tax was eliminated as of January 1 2013. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property. For more information check our list of inheritance tax forms.

In Maryland the tax is only levied if the estates total value is more than 30000. Indiana repealed the inheritance tax in 2013. The Iowa tax only applies to inheritances resulting from estates worth more than 25000.

For deaths occurring in 2013 or later you do not need to worry about. Counties charge the same tax rate for residents and non-residents. Do not file Form IH-6 with an Indiana court having probate.

Overall Indiana Tax Picture. Indiana Inheritance Tax is imposed on the transfer. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Indiana is moderately tax-friendly for retirees.

Historical Indiana Tax Policy Information Ballotpedia

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Learn How Inheritance Works In Indiana Housing Gurus

Indiana Lawmakers Discuss Trigger For Income Tax Cuts

Inheritance Tax Penalizes Those Already Suffering Itr Foundation

Calculating Inheritance Tax Laws Com

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Pa 221 Probate Administration Federal Taxes That Could Be Imposed On Someone S Estate Upon Their Death Unit 8 Taxation Ppt Download

The Death Tax Taxes On Death American Legislative Exchange Council

Indiana Estate Tax Everything You Need To Know Smartasset

Individual Income Taxes Urban Institute

Where Not To Die In 2022 The Greediest Death Tax States

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

State By State Estate And Inheritance Tax Rates Everplans

Indiana Estate Tax Everything You Need To Know Smartasset

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

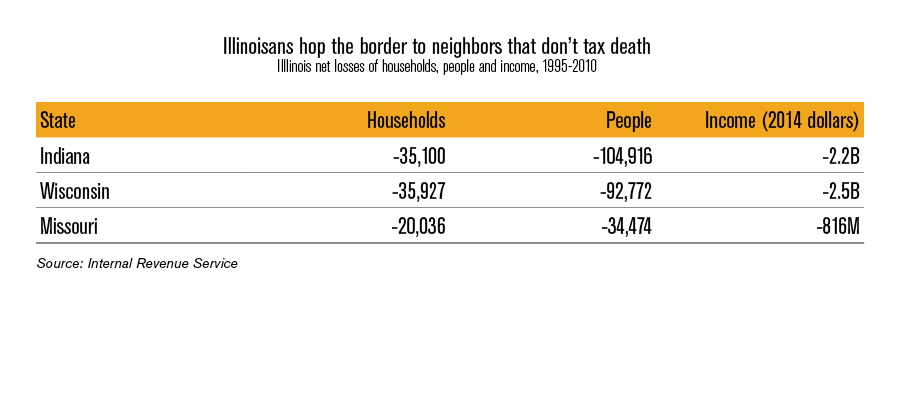

Illinois Should Repeal The Death Tax

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep